Selling a house can be a costly venture. Sellers often have no idea just how much money goes into selling a home till closing day. Some expenses are negotiable, and others might be waived. Here is an overview of the costs to sell a house so you can plan and budget for them.

Real Estate Agent Commissions

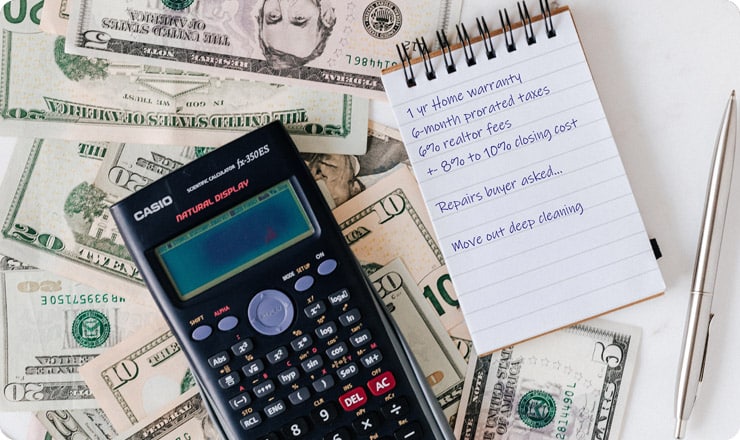

Realtors often receive 5% to 6% of the selling price on a home, and this commission is divided between the seller and buyer agents. An agent does a lot of work, from arranging tours to updating listings to handling paperwork to negotiating with buyers. Sellers can sell without an agent, but this means more work, as well as the loss of leverage that comes with an agent’s knowledge of the market.

Seller Concessions Cost

Seller concessions are buyer expenses a seller agrees to pay, such as a portion of the closing costs, appraisal fees, or inspection fees, to help sweeten the deal, so a buyer is more likely to close on the house. Their loan type often limits the amount a buyer can ask for, but concessions help offset the cost of a higher offer in a competitive market.

Home Repairs

Most buyers do not want to purchase a fixer-upper, which will cost them more money in the long run. For this reason, if issues are found during the home inspection, buyers will ask the seller to make repairs as part of the ongoing negotiations to close the deal.

Home Improvements

Sometimes a home needs a facelift. This could be minor cosmetic work, such as painting the interior, or large upgrades like remodeling the bathroom or kitchen. These changes not only enhance the appeal of a home but its value as well.

Staging

When visiting, buyers want to envision themselves in the home. Sellers can hire a professional to stage the home for greater appeal. They can rearrange furniture, declutter and depersonalize rooms, and repurpose spaces in ways you never imagined. Professionals have their fees, and even if a seller does not hire a stager, they might still pay for professional cleaning services.

Closing Costs

Buyers and sellers pay closing costs. Sellers closing costs can reach 8% to 10% of the sale price. These can include the closing fee paid to the closing agent, property taxes, attorney fees, a transfer tax, title insurance, and the remaining balance of the seller’s original mortgage, as well as any interest accrued.

If you would like to save money, consider selling your home to an investor. Most investors will make a cash offer with fewer negotiations for the terms of sale, and regardless if a property is old or needs repairs. You can enjoy a quick closing, with fewer expenses, and keep a fat wallet.